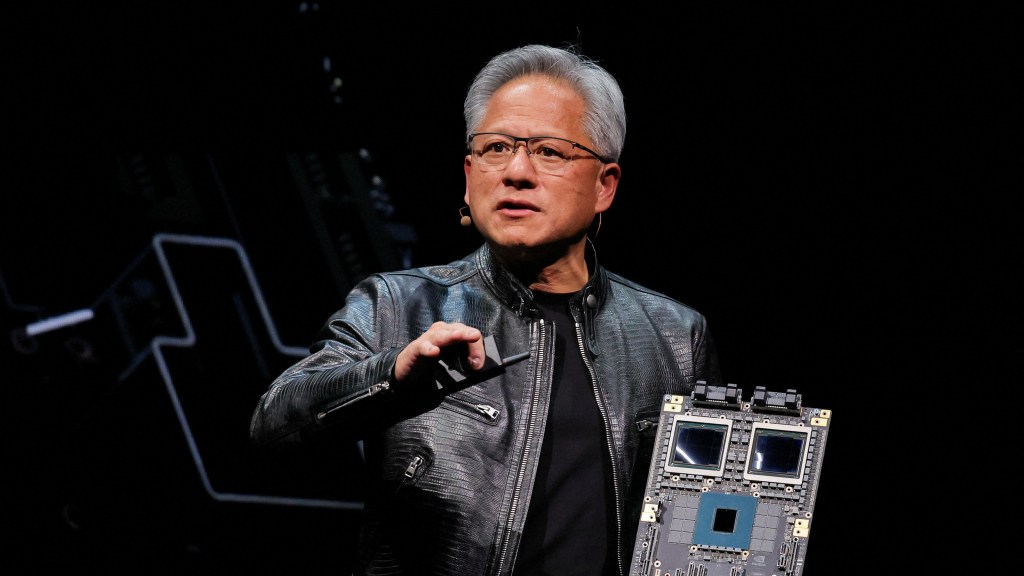

Scottish Mortgage Reduces Nvidia Holdings Amid Rising AI Costs Concerns

Scottish Mortgage Investment Trust has divested £866 million in Nvidia shares over the past six months as the 115-year-old fund expresses caution regarding the escalating costs associated with artificial intelligence (AI).

With a portfolio valued at £11.5 billion, the trust gained notoriety through its early investments in industry giants like Amazon and Tesla, achieving a remarkable total return of over 8,000 percent from Nvidia since its inaugural investment in the semiconductor company in 2016. However, the trust is now distancing itself from Nvidia, a firm whose stock has surged over 200 percent in the last year, largely fueled by increased expenditures on AI technologies.

Tom Slater, the trust’s lead manager, commented, “The main obstacle to widespread AI adoption is the high costs involved. Businesses need to devise ways to deliver competitively priced AI solutions while coping with the rising expenses of training these systems. This situation raises concerns about the viability of ongoing capital machinery investments, which include Nvidia products.”

Despite the sell-off, Nvidia remains the fifth-largest holding in the fund as of the end of September, positioned behind online marketplace leaders Amazon and Mercado Libre.

In the first half ending September, the investment trust recorded a net asset value (NAV) return of 1.9 percent, lagging behind the FTSE All-World index, which achieved a return of 3.6 percent. However, over a decade, the trust has significantly outperformed its benchmark with an NAV return of 348 percent compared to the index’s 211 percent.

Approximately 20 percent of the Scottish Mortgage portfolio is allocated to unlisted companies, including Elon Musk’s space exploration initiative, SpaceX, and ByteDance, the parent company of TikTok. Nonetheless, within this segment, the average valuation saw a decline of 11.3 percent during the considered period.

This decline is partly attributed to the trust’s stake in Northvolt, a battery manufacturer currently facing production hurdles, decreasing demand, and fierce competition from China. Slater emphasized that Northvolt must enact significant improvements to maintain stakeholder trust.

In the first half of the year, shares in Scottish Mortgage traded at an average discount of 8.9 percent to their net asset value, compared to a 16.2 percent discount in the same period in the previous year. This reduction in discount has been facilitated by a substantial buyback initiative, the largest in the sector, with the trust announcing in the spring of the current year its intention to allocate at least £1 billion for repurchasing shares over the next two years. To date, it has repurchased 101 million shares at a total expenditure of £880 million.

Post Comment